The 9-Minute Rule for Hard Money Atlanta

Wiki Article

An Unbiased View of Hard Money Atlanta

Table of ContentsAn Unbiased View of Hard Money AtlantaWhat Does Hard Money Atlanta Mean?Indicators on Hard Money Atlanta You Need To KnowThe Buzz on Hard Money AtlantaThe 3-Minute Rule for Hard Money AtlantaHard Money Atlanta for Dummies

If you can not repay in time, you ought to refinance the loan into a conventional commercial home mortgage to extend the term. Or else, you'll shed the home if you default on your financing. So ensure to cover your bases prior to you take this funding option.Intrepid Private Capital Group uses quickly access to hard cash loan providers and is dedicated to supplying our clients with a personalized service that fulfills and also surpasses their assumptions for a pain-free financing procedure. Whether you are interested in new building, residential advancement, turns, rehab, or various other, we can aid you get the funds you require quicker than the majority of. hard money atlanta.

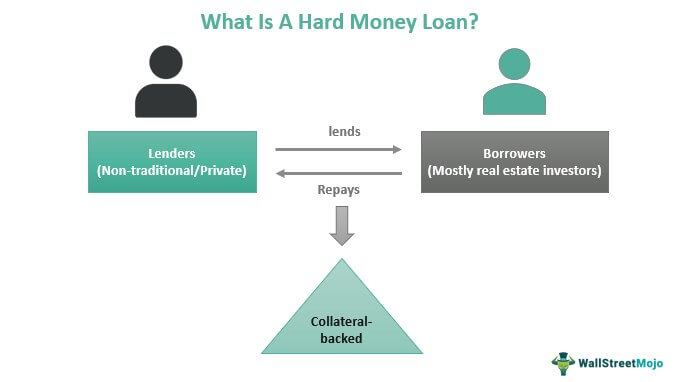

With conventional lendings, loan providers commonly inspect the consumer's capability to repay the finance by looking at his/her credit report, FICO credit report, debt-to-income ratio, etc. While some tough cash lenders might still take these aspects into factor to consider, most base candidateship on the value of the property. The debtor, for example, may put a house or residential property that he or she has - partly or totally - up for security.

About Hard Money Atlanta

Let Intrepid Private Funding Group help you get the personal resources that you require for your company or task. Who Demands a Difficult Cash Financing? While anyone can look for a hard money financing, they are best suited for the following: Residential property flippers Buyers with bad credit history Customers with little-to-no credit Real estate financiers Building developers What is the Loan-to-Value Ratio When taking into consideration a hard money funding, you must pay very close attention to the fees, car loan term, as well as most importantly, the loan-to-value ratio.

Call United States for Added Information Do not hesitate to contact us with any type of inquiries you have (hard money atlanta). Our pleasant team prepares to aid you get your project off the ground!.

Little Known Facts About Hard Money Atlanta.

Difficult money loaning can be rewarding, however as with any business, the opportunities of success boost when particular conditions are satisfied. Difficult money borrowing is more probable to be profitable when: The lending institution comprehends the property market in the locations where it runs. The loan provider can properly identify, underwrite, handle, and service car loans.Make certain you comprehend as well as adhere to other any type of appropriate regulations as well as demands. If you purchase a hard money lending fund, check to make sure the fund abides by suitable regulations and requirements. If you make a decision to come to be a difficult cash lender, either directly or through a fund, make certain to recognize the appropriate revenues and prices, both essential motorists of profitability.

Not all difficult money lending institutions charge all these costs. Hard money lenders incur costs, including underwriting financings, servicing loans, reporting, marketing to customers as well as capitalists, and all the prices that come with running any type of company, such as spending for office area as well as utilities.

How Hard Money Atlanta can Save You Time, Stress, and Money.

As tough money lenders in Arizona, we are frequently asked if we work like standard banks. We do not. One of the most common concerns is "are we a direct lending institution?" That's constantly an outstanding inquiry, and whether you select to collaborate with Funding Fund 1 or otherwise, you need to ask this to every tough money lending institution you shop in Phoenix metro - hard money atlanta.A real hard cash service provider has a source of direct funds, and no middleman to handle your loan. We solution as well as finance all of our very own financings, offering funds for your investment acquisition on part of our capitalists.

Next time you apply for a private home mortgage financing, ask if the broker is a straight lender or if he is just the co-broker., like Funding Fund I, is that we execute all underwriting, paperwork, and finalizings in-house, for that reason we can fund lendings in 24 hrs as well as also quicker in some instances.

Some Known Questions About Hard Money Atlanta.

The collateral is the only point that is underwritten. As a result of this as well as the personal nature of the funds, these kinds of internet fundings are normally able to be moneyed in very brief time frameworks. The major differences between Hard Money and also Conventional or Institutional Lending are: Greater Rate Of Interest Much Shorter Lending Term Larger Down Repayment Requirements Quicker Financing Funding Due to the fact that Hard Money lending institutions don't finance the Consumer their comfort degree with the lending comes from equity (or "skin") that the Debtor places in the offer.With this in mind, the Hard Cash loan provider wants to maintain their funding amount to a number at which the residential image source or commercial property would most likely sell if it was taken to trustee sale. Exclusive lending has become one of the most safe and also most trusted kinds of financing for financial investment house acquisitions.

As a trustee buyer, you don't have a whole lot of time to make a choice as well as you absolutely can't linger for the traditional financial institution to fund your funding. That takes a minimum of thirty day or more, and also you need to act quick. You may just decide to utilize cash money on hand when you most likely to the trustee auctions.

5 Simple Techniques For Hard Money Atlanta

A hard money financing is an ultramodern, secured funding given by a financier to a purchaser of a "difficult property," usually real estate, whose creditworthiness is less important than the value of the possession. Hard cash fundings are a lot more common genuine estate financial investments acquiring a rental home or flipping a home, for example as well as can get you cash swiftly.Report this wiki page